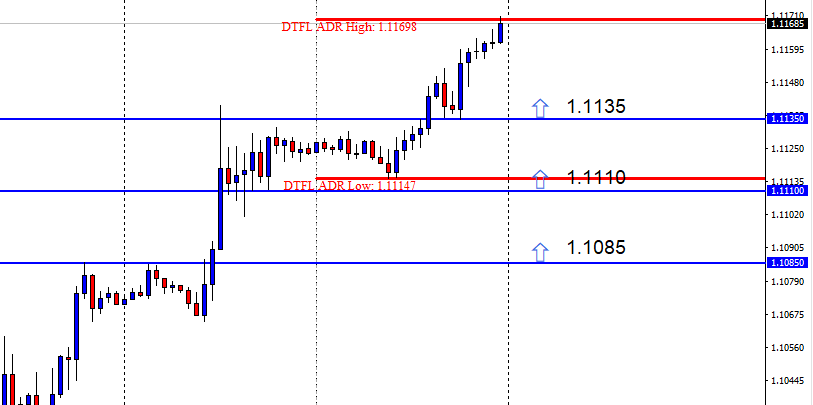

eur/usd

Analysis: This pair began the last week in a range which eventually broke out on Wednesday, and made the 1st push-up. A clear 2nd push followed this to the upside on Thursday, and a third push was completed by Friday.

Since we closed at the highs on Friday and the general Brexit uncertainty still looms markets. We would try to be conservative in selecting manipulation points on this pair for the week ahead.

As we have a complete cycle, we would be moving with an open bias for the week ahead, selecting manipulation points from both sides of the price, but we would only be listing lower levels as there are no upper levels within fair range.

Manipulation Points: Lower 1.1135 & 1.1110 & 1.1085

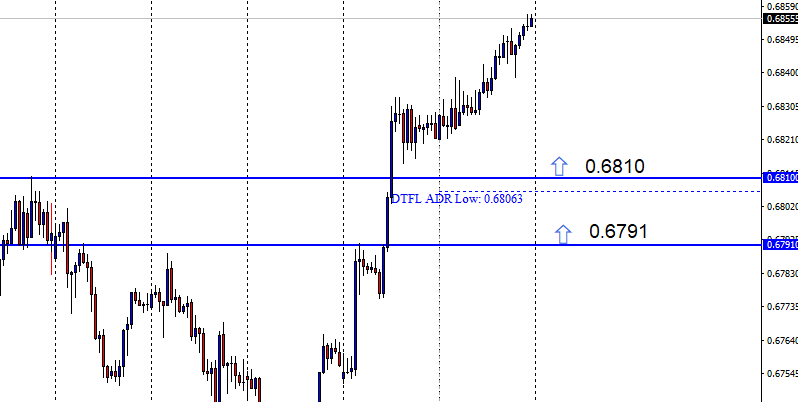

aud/usd

Analysis: Here, we had a clean first push to the upside on Thursday, which was followed by a slow grind higher but didn’t make a valid 2nd push-up on Friday. So, we are keeping our long bias, looking to the trade for the 2nd push to the upside.

Manipulation Points: lower – 0.6810 & 0.6791

usd/jpy

Analysis: This pair has been range-bound for the better half of last week, so we would simply be searching for short-term tests of liquidity/manipulation on both sides of the price.

Manipulation Points: Upper – 108.90 Lower – 108.06

usd/chf

Analysis: The Swissy is very similar to the Aussie, but in the opposite direction. This pair made a valid 1st push to the downside on Thursday and couldn’t follow it up on Friday. Since the bias was not nullified on Friday, we are still looking to trade for the 2nd push to the downside.

Manipulation Points: Upper – 0.9891 & 0.9908

nzd/usd

Analysis: We had a successful first push to the upside on Thursday, but while this Friday made an upward momentum, we still didn’t make a valid 2nd push to the upside. So our upward bias remains on this pair.

Manipulation Points: Lower – 0.6354

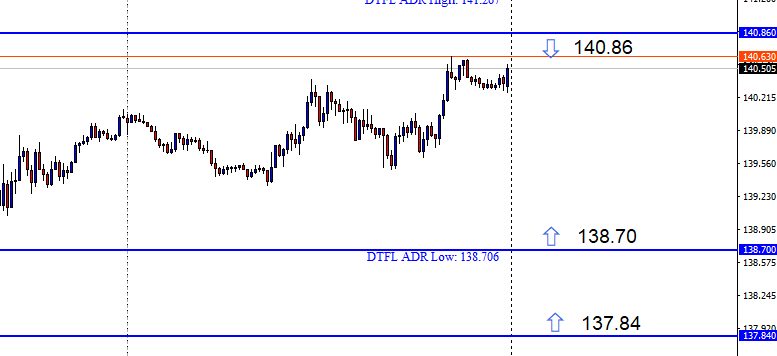

gbp/jpy

Analysis: This is one of the pairs to be careful with this coming week because of the pending parliamentary vote on the new Brexit deal. For now, we have an open bias, so we would set our levels accordingly.

Manipulation Points: Upper – 140.86 Lower – 138.70 & 137.84

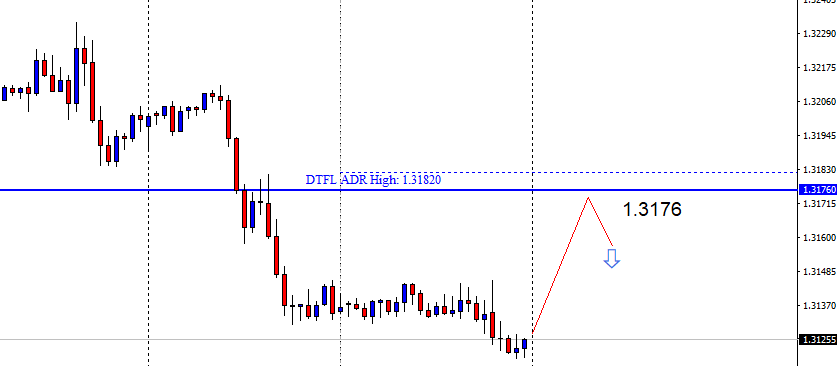

usd/cad

Analysis: We had a clear first push on Thursday on this pair but only followed it with a day of sideways price action. Therefore, our downside bias on this pair stays moving into the new week.

Manipulation Points: Upper – 1.3176

Important Disclaimer: At Day Trading Forex Live (DTFL), we have specific entry, exit, and trade management rules that are used to trade these levels. You should not blindly enter at the levels without first doing your own research and ensuring you have a trading plan in place.

If you would like to learn more about the bank trading strategy, member’s community and live training room, you can do so by Clicking Here.

Happy Trading

Sterling

* This article was originally published here

No comments:

Post a Comment