* This article was originally published here

Tuesday, December 31, 2019

Selling the Aussie Dollar and EUR today – Currency Strength and Weakness for Monday 16th December 2019

Selling the Aussie Dollar and EUR today – Currency Strength and Weakness for Monday 16th December 2019 Hi Forex Trader, I make my Currency Strength and Weakness suggestions every day based on where I see the market heading over the next 24 hours. Use my analysis below to aid your trading and to help you […]

The post Selling the Aussie Dollar and EUR today – Currency Strength and Weakness for Monday 16th December 2019 appeared first on Online Forex Trading Course.

* This article was originally published here

31.12.19 Forextrade1 - Copy Trading 2nd Live Streaming Profit Rise To $2900k From $1260k Video.

#top_forex_trading #top_forex_trading_apps #top_forex_trading_platforms #copytrading 4 days Live Video Streaming kept integrated & maintained in below msg —95% of new positions are closed on the Daily Basis —Day trade strategy(6hrs to 24hrs Profit/Loss booking Cycle) —5% remaining positions are kept open with Trailing SL which move with the price (Risk=0) to increase reward gradually —Rollover strategy (Holding period AUTO mode till Trail SL-hit, approx 2 to 3months Cycle) This is the proof the Our MAIN ACCOUNT IS being maintained rigorously, It gives you an insight of our -Trading Discipline -Trading Strategies -Profit Booking Methods -Swing Trading -Trend Trading -Hedging Strategy -Revising Stop Loss system -Averaging LOTS https://ift.tt/2YoQzQW... ==== 31.12.19 2nd Live Streaming Profit Rise To $2900k From $1260k https://youtu.be/uQ01zYKFVyU 31.12.19 1st Live Streaming Profit book 95% new position close=$672k Running Profit 5% old position open=$1260k https://youtu.be/3DQLrxW5iFI 30.12.19 2nd Live Streaming Profit Rise To $2850k From $1144k https://youtu.be/Md-mGQFKRCY 30.12.19 1st Live Streaming Profit book 95% new position close=$688k Running Profit 5% old position open=$1144k https://youtu.be/aicEtS6YthU 27.12.19 2nd Live Streaming Profit Rise To $2930k From $1280k https://youtu.be/6ltFxMFI9vw 27.12.19 1st Live Streaming Profit book 95% new position close=$525k Running Profit 5% old position open=$1280k https://youtu.be/5RXAO3zDXjQ 26.12.19 1st Live Streaming Profit Running $3170k https://youtu.be/OuvlCC6tzEA ===== Remember that Forex Tradings are a leveraged product and can result in the loss of your entire capital. Trading Forex Markets may not be suitable for you. Please ensure you fully understand the risks involved. Please read our Risk Disclosure Statement and our User Agreement before using our services.

View on YouTube

31.12.19 Forextrade1 - Copy Trading 2nd Live Streaming Profit Rise To $2900k From $1260k Video.

#top_forex_trading #top_forex_trading_apps #top_forex_trading_platforms #copytrading 4 days Live Video Streaming kept integrated & maintained in below msg —95% of new positions are closed on the Daily Basis —Day trade strategy(6hrs to 24hrs Profit/Loss booking Cycle) —5% remaining positions are kept open with Trailing SL which move with the price (Risk=0) to increase reward gradually —Rollover strategy (Holding period AUTO mode till Trail SL-hit, approx 2 to 3months Cycle) This is the proof the Our MAIN ACCOUNT IS being maintained rigorously, It gives you an insight of our -Trading Discipline -Trading Strategies -Profit Booking Methods -Swing Trading -Trend Trading -Hedging Strategy -Revising Stop Loss system -Averaging LOTS https://ift.tt/2YoQzQW... ==== 31.12.19 2nd Live Streaming Profit Rise To $2900k From $1260k https://youtu.be/uQ01zYKFVyU 31.12.19 1st Live Streaming Profit book 95% new position close=$672k Running Profit 5% old position open=$1260k https://youtu.be/3DQLrxW5iFI 30.12.19 2nd Live Streaming Profit Rise To $2850k From $1144k https://youtu.be/Md-mGQFKRCY 30.12.19 1st Live Streaming Profit book 95% new position close=$688k Running Profit 5% old position open=$1144k https://youtu.be/aicEtS6YthU 27.12.19 2nd Live Streaming Profit Rise To $2930k From $1280k https://youtu.be/6ltFxMFI9vw 27.12.19 1st Live Streaming Profit book 95% new position close=$525k Running Profit 5% old position open=$1280k https://youtu.be/5RXAO3zDXjQ 26.12.19 1st Live Streaming Profit Running $3170k https://youtu.be/OuvlCC6tzEA ===== Remember that Forex Tradings are a leveraged product and can result in the loss of your entire capital. Trading Forex Markets may not be suitable for you. Please ensure you fully understand the risks involved. Please read our Risk Disclosure Statement and our User Agreement before using our services.

View on YouTube

USD Strength Rising Amid Trade Talk Progress – Nov 10th, 2019 Weekly Forex Analysis

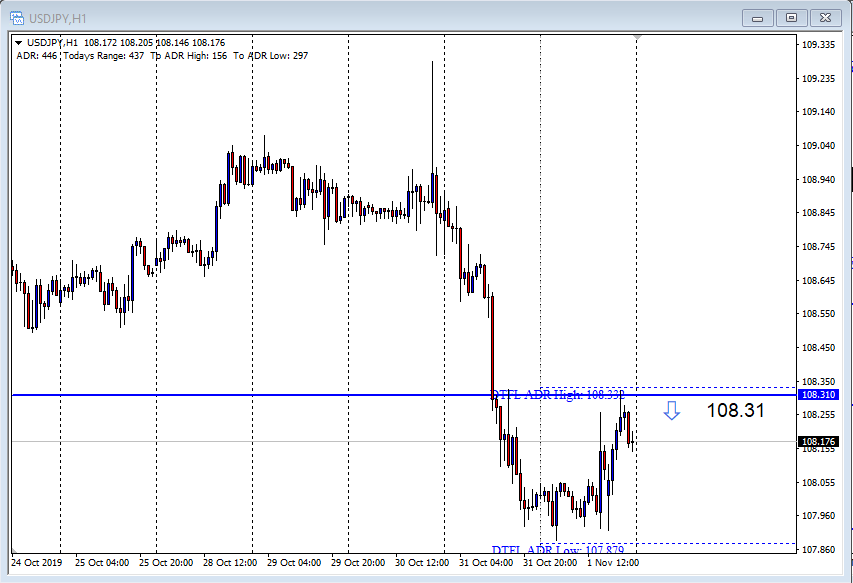

We saw markets react to the somewhat positive news coming from the US and China in regard to potential tariff agreements. They both decided to rollback on the ongoing tariffs as part of phase one of the trade deal. This gave a boost to the dollar across the board as we saw the USD gain against all the majors.

In regards to the forex bank trading strategy, the EUR/USD complete a three-cycle push to the downside. This week we will continue to lean towards Dollar strength across the board until shown otherwise with a upward market cycle.

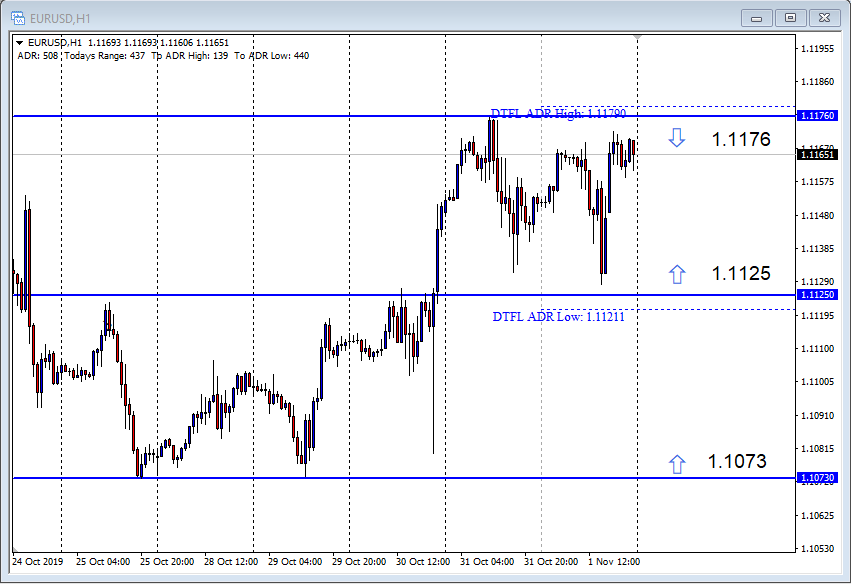

eur/usd

Analysis: This pair made the complete 3 pushes to the downside last week. So, we have to open up the bias moving into the new week, but we currently have no lower levels, so we are listing all the upper levels.

Manipulation Point/s: Upper – 1.1057

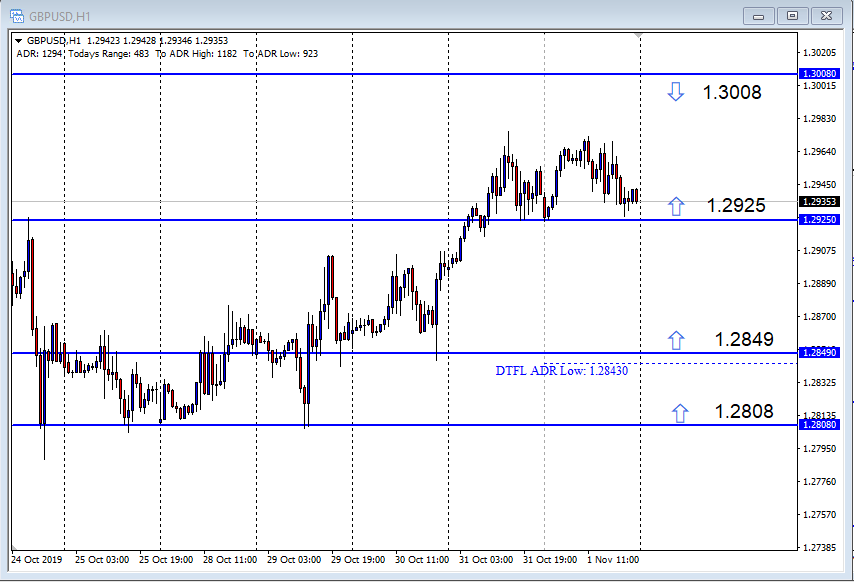

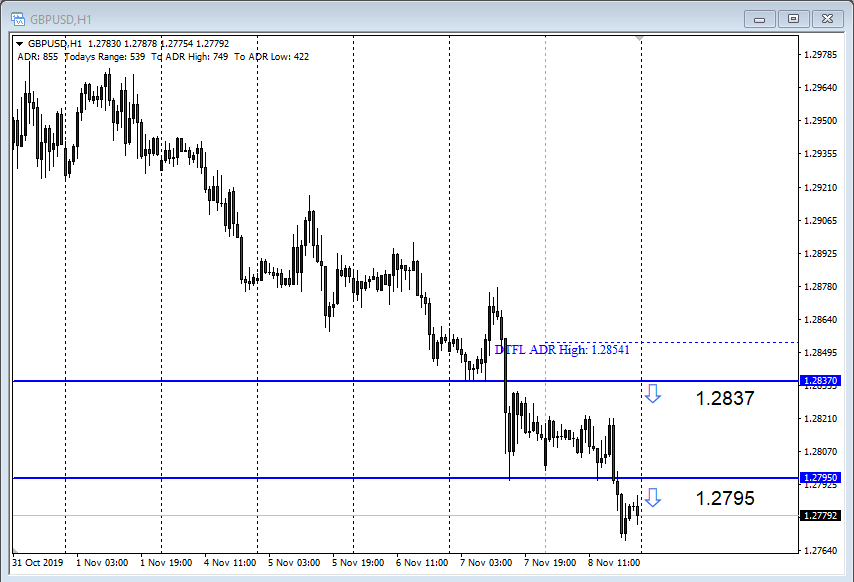

GBP/usd

Analysis: The pound has been in a downtrend for the whole of this last week but only made a valid first push to the downside on Thursday. So we would be trading for the second push in that same direction.

Manipulation Point/s: Upper – 1.2795 & 1.2837

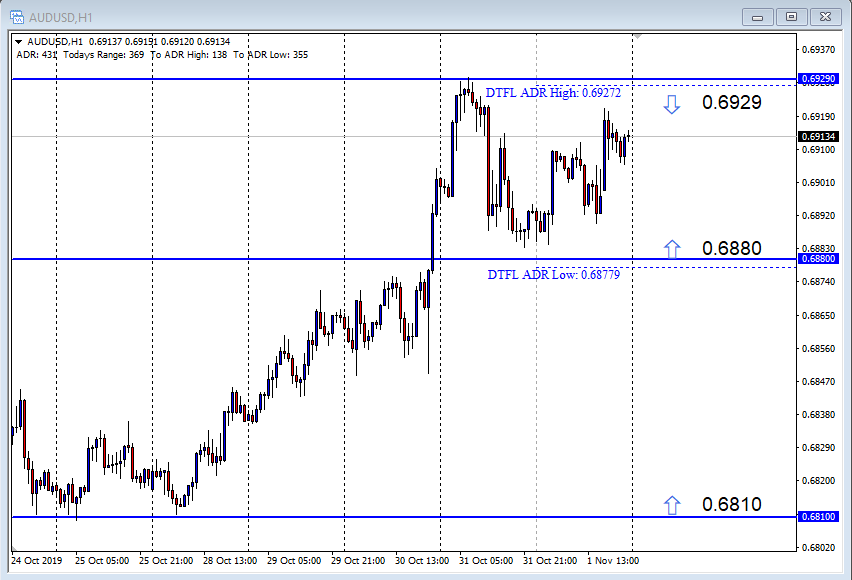

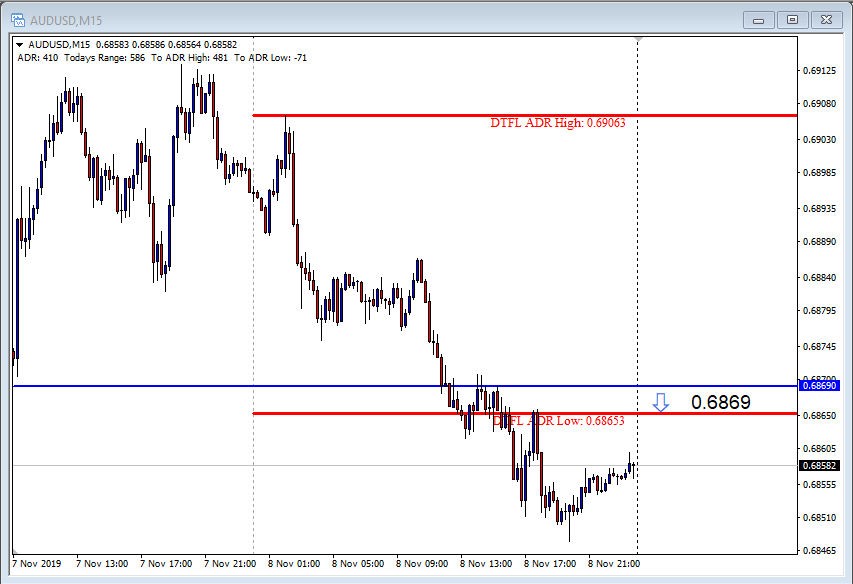

AUD/usd

Analysis: Here, we had a double top form on Thursday, and it was followed by a clean 1st push to the downside on Friday. This is a classic example of how bias is created. Now we would be trading for the 2nd push to the downside.

Manipulation Point/s: Upper – 0.6869

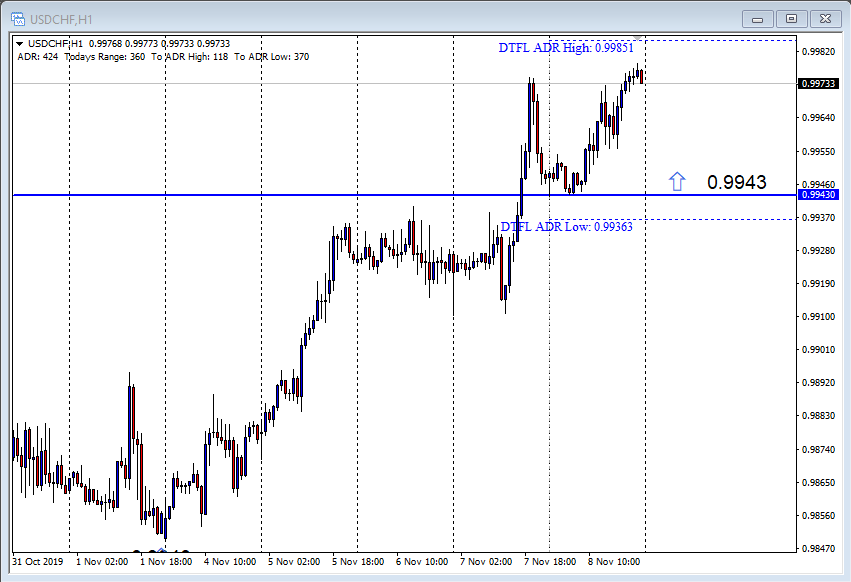

usd/chf

Analysis: Continuing the bullish run for the dollar, here we also have had two clear pushes to the upside on Tuesday and Thursday. As Friday did not nullify the bias, we would be looking to trade for the 3rd push to the upside.

Manipulation Point/s: Lower – 0.9943

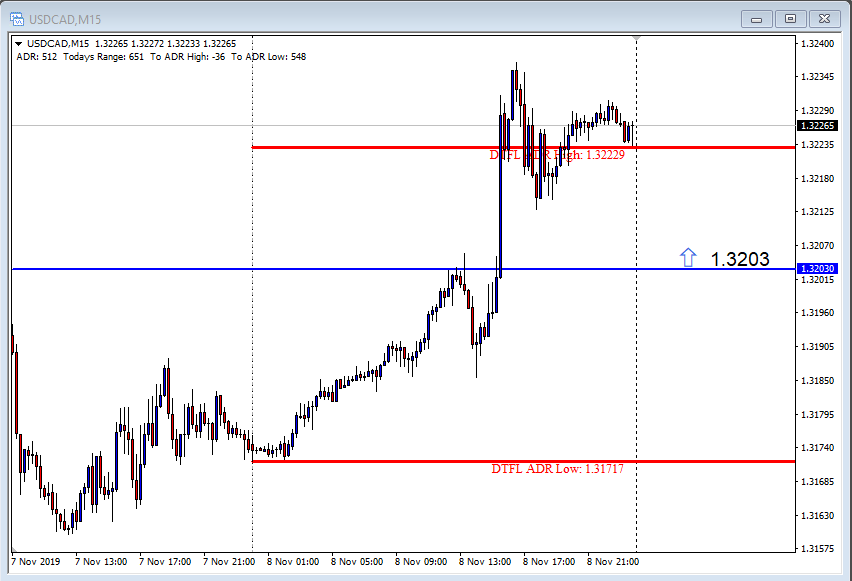

usd/cad

Analysis: The market here broke out of the range held for most of the week and made a valid 1st push to the upside. So we are looking to trade for the 2nd pushup in favor of the strong USD.

Manipulation Point/s: Lower – 1.3203

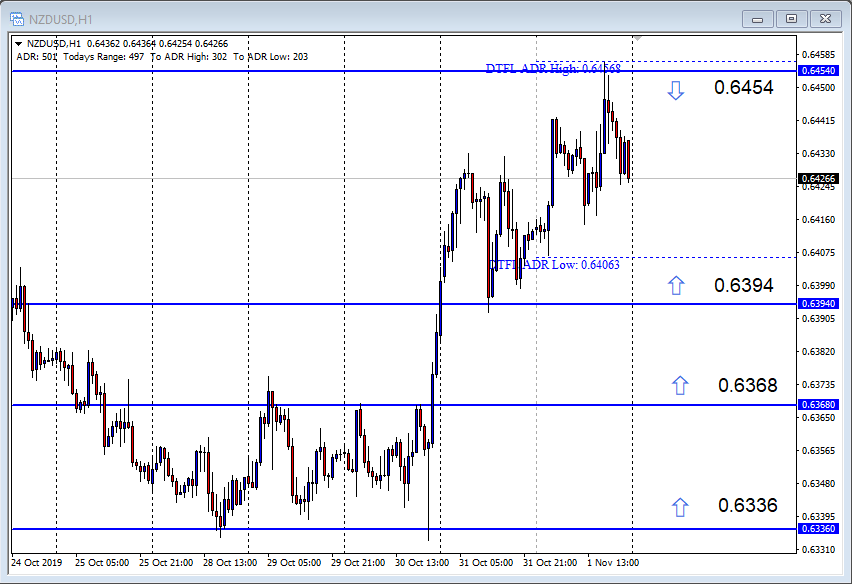

nzd/usd

Analysis: Here, the market broke out of the range on Friday, making a valid first push to the downside. So we are trading for the 2nd push to the downside.

Manipulation Point/s: Upper – 0.6344

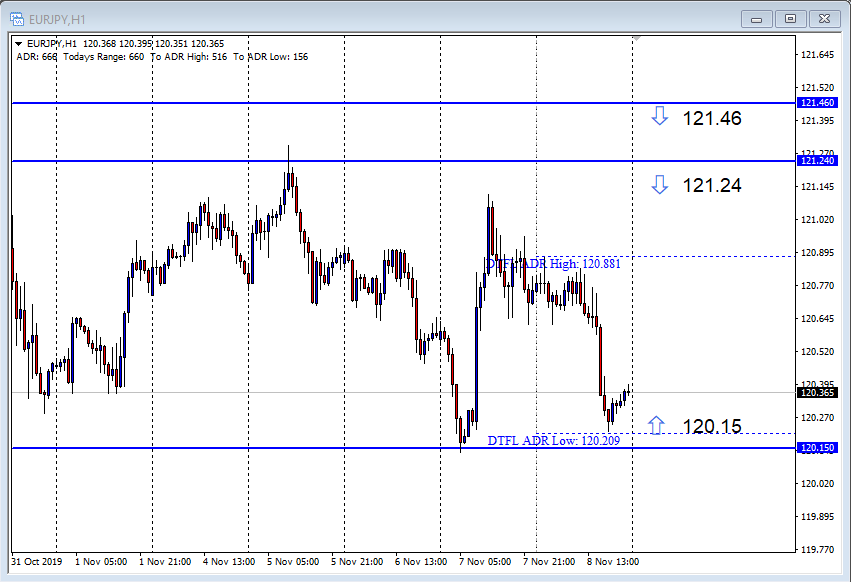

eur/jpy

Analysis: We have a clear range-bound move on this pair. We will continue to trade with an open bias, looking to go long from lower manipulation points and short from upper levels.

Manipulation Point/s: Upper – 121.24 & 121.46 Lower – 120.15

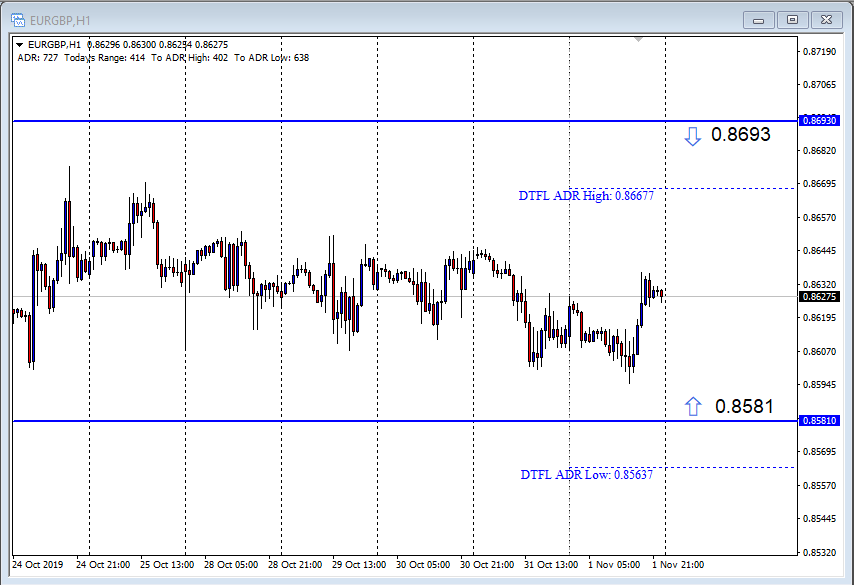

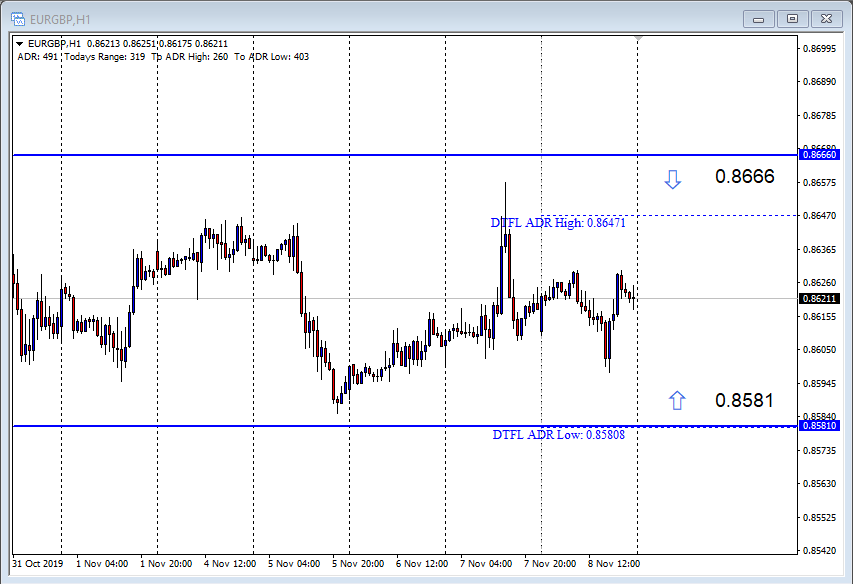

eur/Gbp

Analysis: This Pair is still moving in the sideways price action, which it has held for weeks now. We would be keeping our bias open as we have done so far in anticipation of catching the possible reversals from the upper and lower bound of the range.

Manipulation Point/s: Upper – 0.8666 Lower – 0.8581

Important Disclaimer: At Day Trading Forex Live (DTFL), we have specific entry, exit, and trade management rules that are used for trading these levels. You should not blindly enter the levels without first doing your own research and ensuring you have a trading plan in place.

If you would like to learn more about the bank trading strategy, member’s community, and live training room, you can do so by Clicking Here.

Happy Trading

Sterling

* This article was originally published here

Weekly Forex Trading Calendar for Week of December 30, 2019

We have just posted our weekly news trading calendar for the week of Dec 30, 2019. You can download the pdf and excel file by clicking on the Read More Link. These are soft biases on economic data and not trades that we directly trade or track like BK Swing and News.

Excel version of calendar123019

* This article was originally published here

Weakness returns to the US Dollar and Japanese Yen as the Euro and Aussie Dollars continue to rise – Currency Strength and Weakness for Thursday 4th April 2024

Weakness returns to the US Dollar and Japanese Yen as the Euro and Aussie Dollars continue to rise – Currency Strength and Weakness for Thur...

-

Forex Fast System - 1 Minute Timeframe Trading System trading - ClickBank Results • February 12, 2014, 12:00 am ...

-

PBOC sets USD/ CNY reference rate for today at (vs. yesterday at 6.9811) ForexLive * This article was originally published here ...

-

G7 statement still under discussion ForexLive * This article was originally published here