* This article was originally published here

Forex Trading🔹Forex trading tips, strategies, and resources to help you succeed in the world’s largest financial market. Learn how to trade forex like a pro with tools for beginners, chart analysis, indicators, risk management, and daily insights. Whether you’re just starting or scaling up, this blog provides the essential knowledge you need to master forex trading.

This last week had some historical changes, as Powell and the Federal Open market Committee (FOMC) decided on a 25 basis point decrease in the federal funds rate this past Wednesday. We saw massive sell of the US Dollars but was somewhat halted on Friday when positive non farm payrolls came out. Overall we still have dollar weakness across the board, but we are proceeding with caution as all other macro indicators remain positive for the dollar.

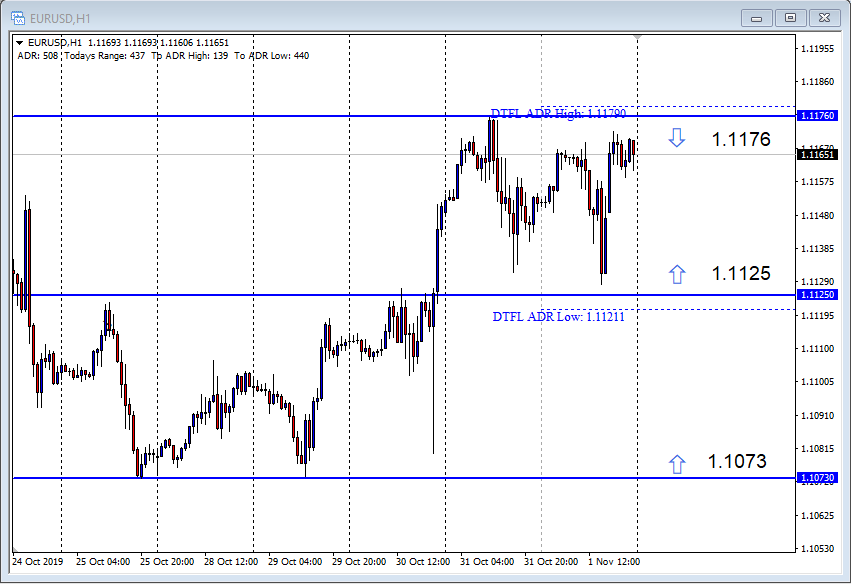

Analysis: This shows the weakness in the dollar as the pair broke out of its downtrend, which was there all of the previous weeks. However, the last two days of this week the price was stuck in a sideways range. As such, we will keep an open bias moving into the new week.

Manipulation Points: Upper – 1.1176 Lower – 1.1125 & 1.1073

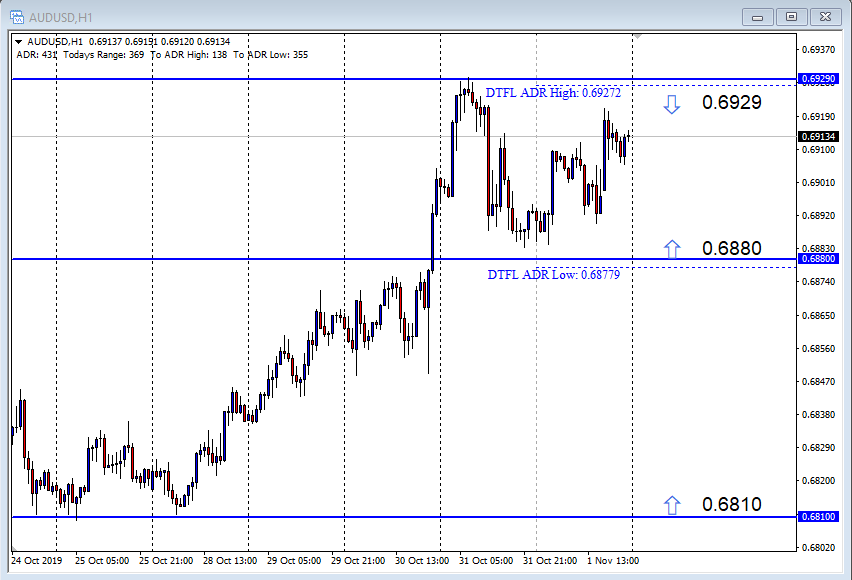

Analysis: Similar to most dollar-based pairs, Thursday and Friday both moved sideways and nullified any long bias you might have on the pair due to the rate cut.

We would be looking to trade levels on both sides of the price.

Manipulation Points: Upper – 0.6929 Lower – 0.6880 & 0.6810

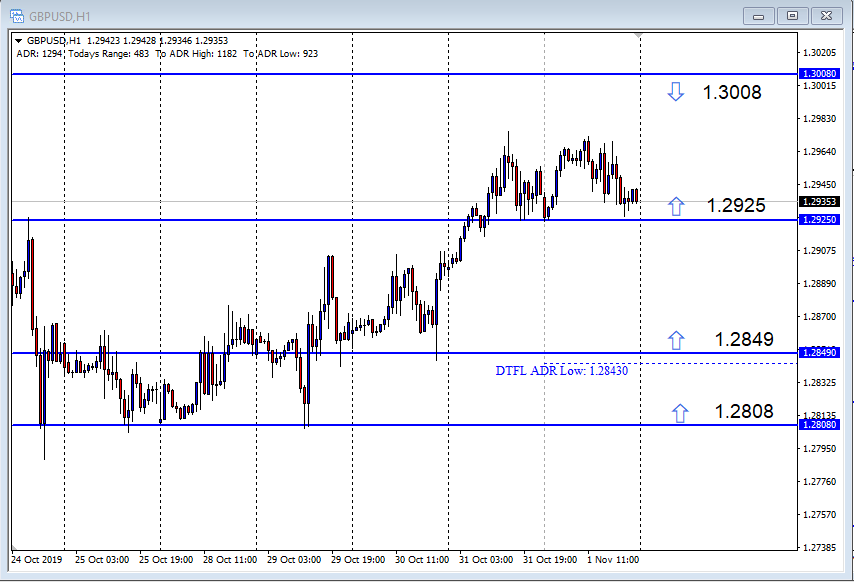

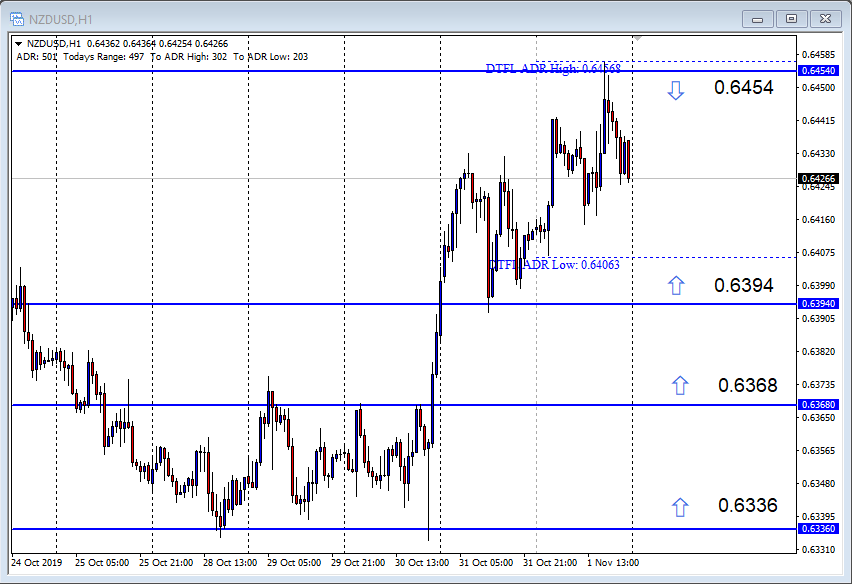

Analysis: We had two sideways days on Thursday and Friday. So we would be having an open bias as well on this pair. Recognizing the existing dollar weakness, we are leaning more to levels in the long direction.

Manipulation Points: Upper – 1.2925 & 1.3008 Lower – 1.2849 & 1.2808

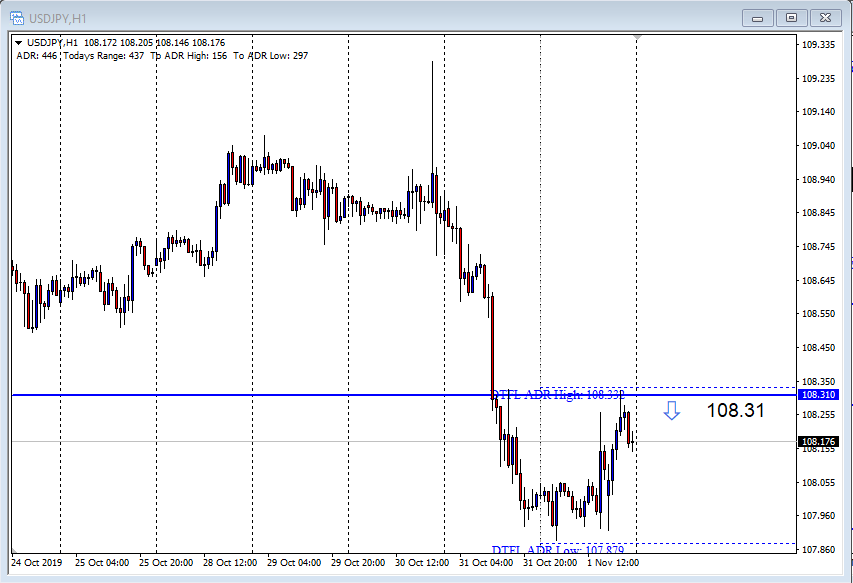

Analysis: Here we had price continue the sell-off in the dollar on Thursday, creating a valid 1st push to the downside. While the price made a short correction on Friday, it still didn’t invalidate the bias.

So, we are trading for the second push to the downside.

Manipulation Point: Upper – 108.31

Analysis: We made two sideways price action on this pair on Thursday and Friday. So despite the dollar induced bullish move, we are trading manipulation points to both sides of the price.

Manipulation Point: Upper – 0.6454 Lower – 0.6394 & 0.6368 & 0.6336

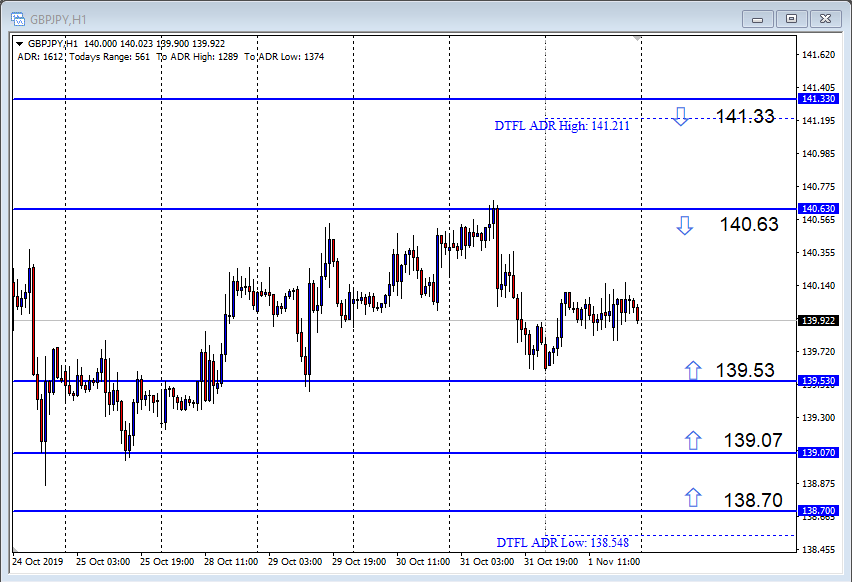

Manipulation Point: Upper – 140.63 & 141.33 Lower – 139.53 & 139.07 & 138.70

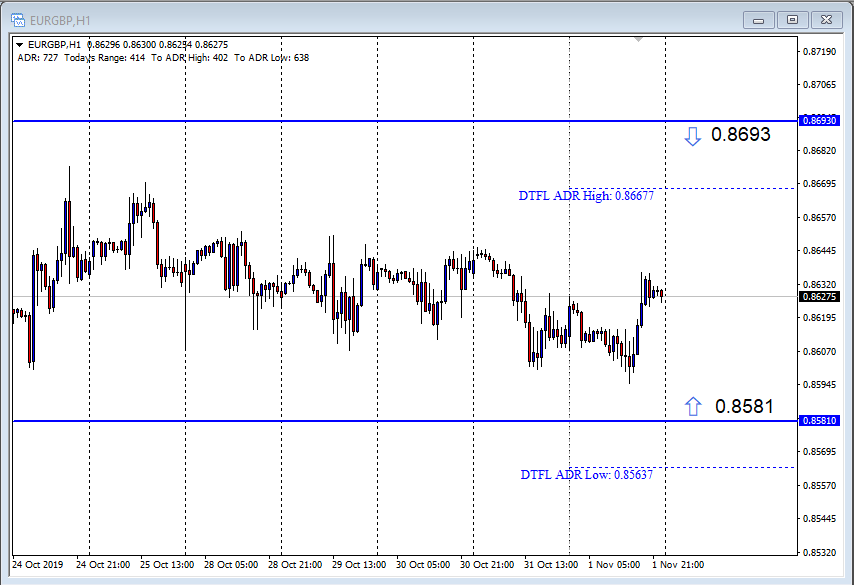

Analysis: Another range-bound market. This pair has stayed within this range for over two weeks now. We still hoping to catch a good long or short from the lower or upper bound.

Manipulation Points: Upper – 0.8693 Lower – 0.8581

Important Disclaimer: At Day Trading Forex Live (DTFL), we have specific entry, exit, and trade management rules that are used for trading these levels. You should not blindly enter the levels without first doing your own research and ensuring you have a trading plan in place.

If you would like to learn more about the bank trading strategy, member’s community, and live training room, you can do so by Clicking Here.

Happy Trading

Sterling

No comments:

Post a Comment